By: Staff Writer

A public dispute over Liberia’s national budget has intensified after a former finance minister and sitting senator Amara Konneh criticized the House of Representatives’ passage of the FY2026 budget, prompting a detailed rebuttal grounded in fiscal law and historical budget data.

At the center of the controversy are budgetary transfers, a standard public finance mechanism permitted under Liberia’s Public Financial Management (PFM) Act to address emergencies and unforeseen expenditures within approved appropriations.

Critics have portrayed the transfers as evidence of fiscal recklessness. However, budget experts S. Emmanuel Lloyd argue that the data tell a markedly different story.

Transfers Are a Legal Fiscal Instrument, Not Financial Misconduct

Responding to Senator Konneh”s assertions, Llody said Budgetary transfers, when conducted within statutory limits and approved frameworks, are internationally recognized tools of fiscal management.

According to analyst Llody , characterizing them as inherently irresponsible risks misinforming the public and undermining confidence in Liberia’s budget process.

“Public finance debate requires precision and context,” said Emmanuel Llody who is familiar with the FY2026 framework. “Without that, political rhetoric replaces evidence-based oversight.”

Historical Data Challenges the Narrative

A review of Liberia’s recent fiscal history highlights stark contrasts between past and present budgetary practices.

FY2012/2013:

Transfers and reallocations from the Public Sector Investment Program (PSIP) totaled US$192.5 million

Against a national budget of US$672.1 million

Representing 28.6 percent of the entire budget

Fiscal analysts note that such a level of movement would ordinarily trigger heightened legislative scrutiny.

FY2013/2014:

Transfers declined to US$74.7 million

From a US$582.9 million budget

Equal to 12.8 percent, significantly lower but still substantial

By contrast:

FY2025:

Transfers stood at US$33 million by end-October

Projected to reach US$40 million by year-end

From a total budget of US$880.66 million

Amounting to approximately 4.5 percent

This figure remains well below statutory thresholds and far lower than levels recorded during earlier fiscal years.

“By any objective measure, FY2025 transfers are modest and compliant with the law,” the consultant Llody noted.

“They are neither excessive nor alarming.”

Why Reallocations Occurred in FY2025

Officials confirm that FY2025 reallocations were driven by unforeseen national obligations, including:

Conduct of by-elections in Nimba County, District 5

Reburial of former presidents and national statesmen

Settlement of government arrears owed to LIBTELCO

Payment of African Peer Review Mechanism obligations

Acquisition and transportation of military equipment

Medical assistance to former youth and student leaders

Expanded healthcare support for children under five at JFK Maternity Center

Notably, none of the reallocations were directed toward operational spending at the Ministry of Finance and Development Planning (MFDP).

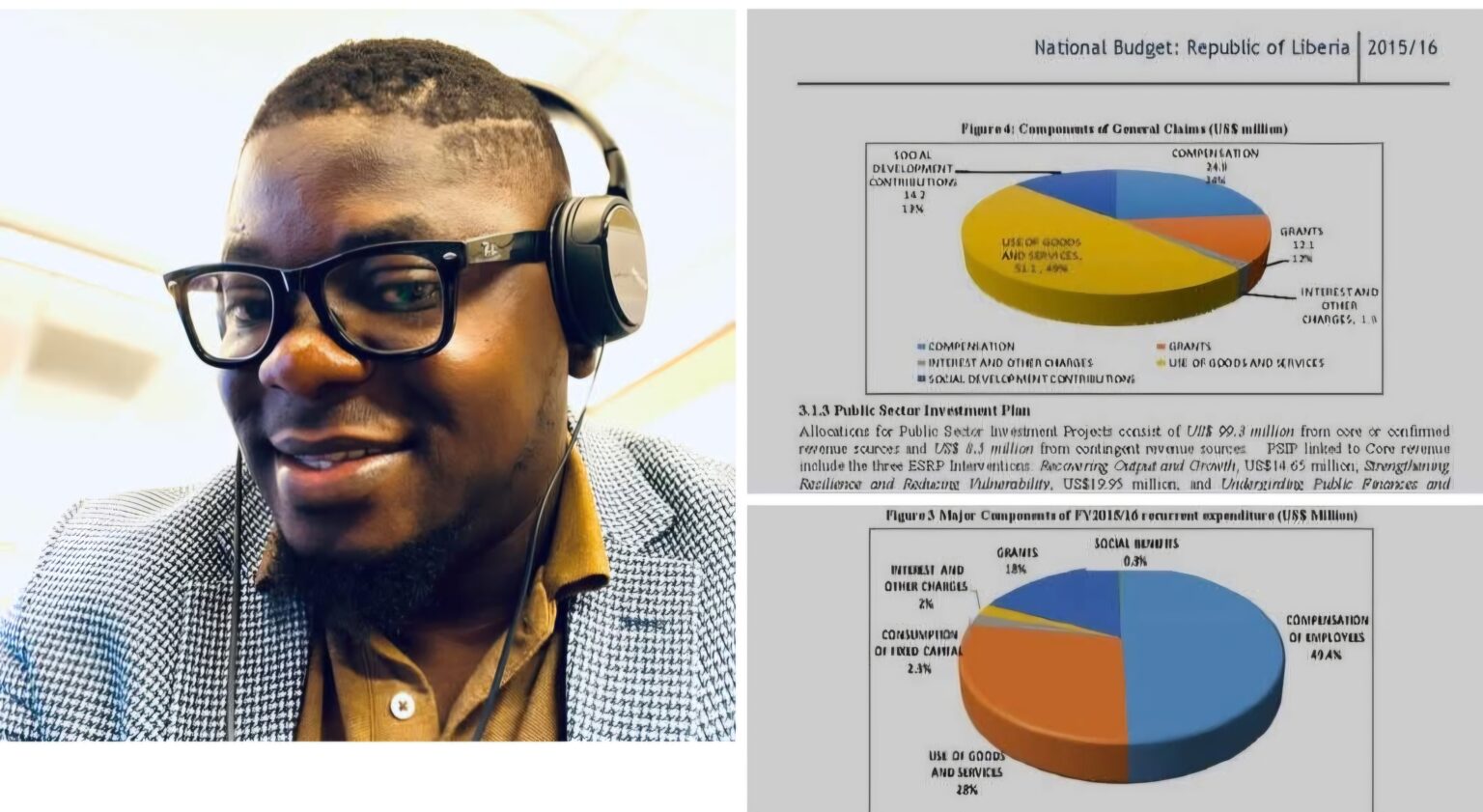

Debate Over ‘General Claims’ Spending

The dispute has also extended to allocations under General Claims, a budget category used internationally to capture government-wide expenditures that cannot be attributed to a single institution.

These include:

Debt repayment and interest obligations

ECOWAS Trade Levies

Social benefits

Banking and transaction charges

Historical records show that during earlier administrations:

FY2014/2015: General Claims totaled US$60.4 million

FY2015/2016: The figure rose to US$102.8 million

The FY2026 budget introduces a refined classification : General Government Expenditure aimed at separating institutional operational costs from national obligations, a move officials say enhances transparency and accountability.

A Call for Evidence-Based Fiscal Oversight

Budget analysts Llody caution that Liberia’s economic challenges require sober, data-driven discussion rather than sensational claims.

“Transfers are not a sign of failure when they are lawful, transparent, and limited,” he emphasized. “They are a response to real-world contingencies that no budget can perfectly predict.”

As debate continues, experts stress that fiscal oversight should be anchored in law, historical context, and empirical evidence, not political expediency.

Liberia’s budgetary transfers, particularly in FY2025, fall well within legal and international norms.

While scrutiny is essential, analysts argue that framing lawful reallocations as fiscal chaos risks misleading the public and weakening informed debate.

What the country needs, observers conclude, is disciplined budget execution, vigilant legislative oversight, and an honest conversation about managing scarce public resources in the national interest and not rhetoric untethered from the numbers.